Calculate your contributions and RAFP points

How are your contributions calculated?

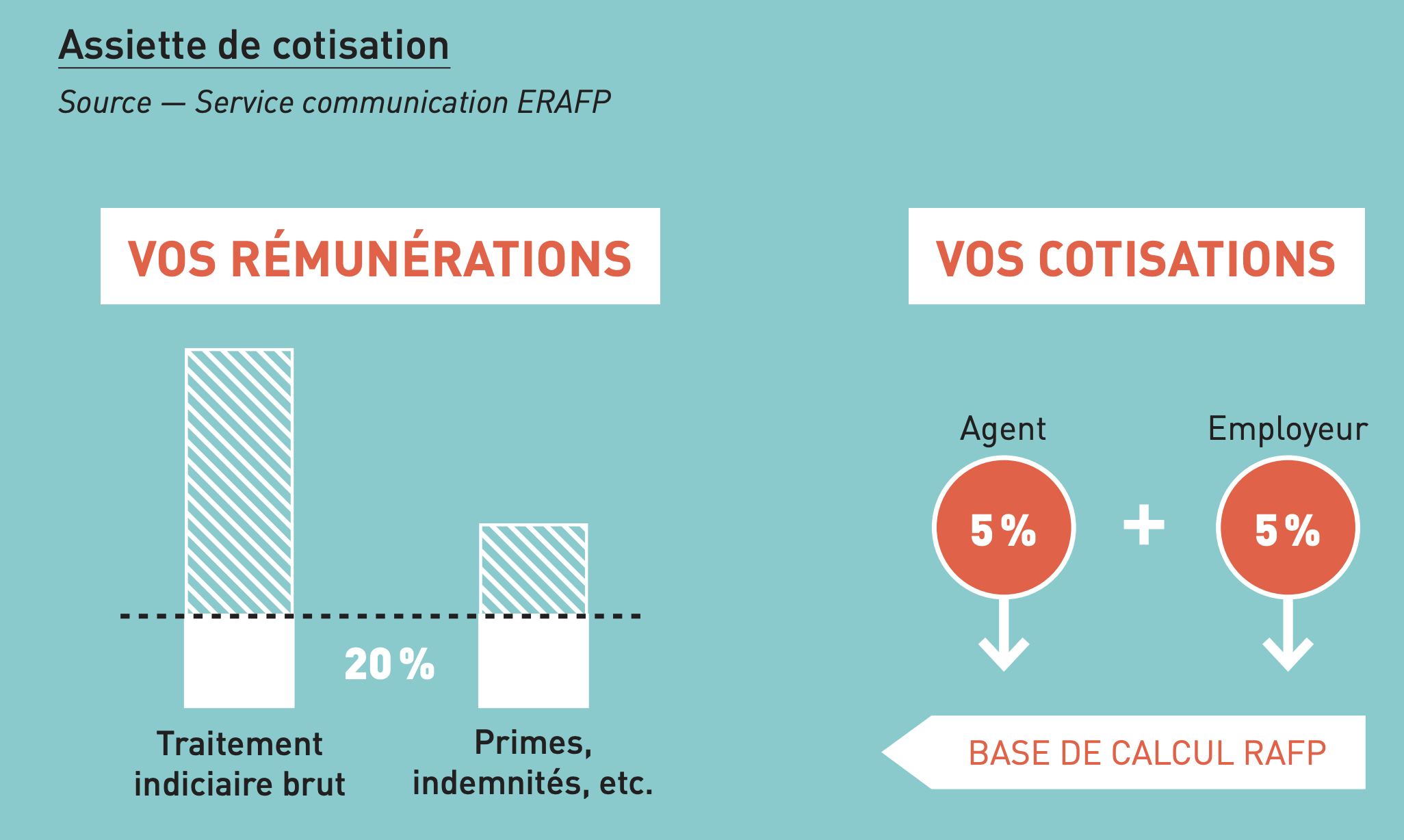

The contribution base for the RAFP is made up of all allowances, bonuses and other ancillary remuneration which do not give rise to contributions to the basic civil service schemes. Benefits in kind are also taken into account for their tax value.

The contribution base for the RAFP is made up of all allowances, bonuses and other ancillary remuneration which do not give rise to contributions to the basic civil service schemes. Benefits in kind are also taken into account for their tax value.

The contribution base for the RAFP is capped at 20% of the gross indexed salary and the contribution rate is set at 10% of the amount of the base: 5% is payable by the civil servant and 5% by the employer.

There are two exceptions to the application of the 20% cap:

- The "individual purchasing power guarantee" (GIPA) allowance, which is fully subject to RAFP contributions, without application of the 20% ceiling.

- Days registered on the Time Savings Account (CET), which can be converted into RAFP points (beyond 15 days stored).

How are your RAFP points calculated?

The number of points that are recorded on your individual retirement account (CIR) for a year is calculated as follows:

Total amount of contributions for the year / acquisition value of the point

Example: for 2021, your CIR records a contribution (employer's and employee's share) of €350, the acquisition value of the point in 2021 being €1.2503, you will therefore obtain 280 points (result rounded up).

The points acquired in a given year will appear on your CIR in the first quarter of the following year, as this is when your employer will send the declaration showing the contribution paid on your behalf.

If you disagree with the amount of your RAFP contributions, you should contact your employer. Only your employer has the information needed to calculate your contributions.

Points values

The acquisition value and the service value of the RAFP point are set each year by the ERAFP's Board of Directors.

The acquisition value of the point is used to determine the number of points obtained during the year. The amount of the additional benefit is then calculated by multiplying the number of points acquired throughout the career by the service value of the point.

| Year | 2005 | 2006 | ... | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| Purchase value | 1 € | 1,017 € | 1,2452 € | 1,2502 € | 1,2740 € | |

| Change | - | + 1,7 % | ... | + 1,1 % | + 1,1 % | + 1,9 % |

| Service value | 0,04 € | 0,0408 € | ... | 0,04656 € | 0,04675 € | 0,04764 € |

| Change | - | + 2 % | ... | + 1,6 % | + 1,1 % | + 1,9 % |

Points calculator

This tool allows you to calculate your RAFP points from the contributions paid by your employer, and to compare the result with the number of points actually registered in your rights account, which will be used to calculate your benefit.