About us

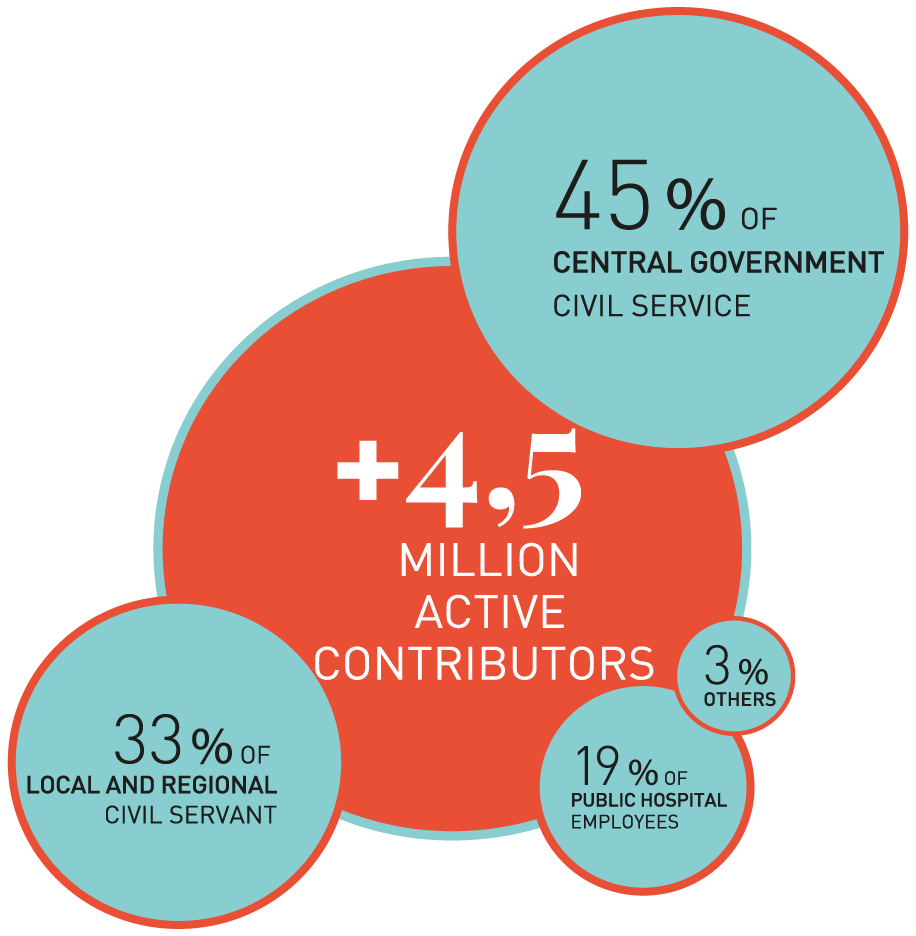

The public sector additional pension scheme (RAFP) is a mandatory, points-based scheme created for fully qualified and trainee civil servants working in French central government (civilians and military), local and regional authorities and the public hospitals sector, as well as members of the judiciary. Thanks to the Scheme, close to 4.5 million contributors benefit from additional pension benefits.

The French public additionnal pension scheme (ERAFP) is the public-sector administrative entity that manages this pension scheme.

Organisation and operation

The RAFP was established by the 2003 pension reform law and has been operating since January, 1st 2005.

It provides civil servants with a supplementary income to the pensions paid by Caisse nationale de retraite des agents des collectivités locales (CNRACL) and Service des Retraites de l’État (SRE), the basic public service schemes for local authority and central government employees, respectively.

The Scheme works on a capitalisation principle. Each beneficiary thus has an individual RAFP retirement account that they can access and consult via their personal space and in which their RAFP points accumulate. Each year, the employer declares its employees’ contributions (the contribution rate being split equally between employer and employee, with each paying 5%), calculated on their ancillary remuneration up to a limit of 20% of the gross basic salary.

These contributions are then converted into points which, multiplied by the service value of a point, give the amount of the benefit that the employee receives.

As a State-owned public institution, ERAFP applies principle of segregation of the functions of authorising entity and public accountant. The State appoints a Public Accountant with sole responsability, personal and financial, for paying ERAFP's expenses, collecting its revenues, handling funds and keeping its account.

Beneficiaries

The RAFP is a mandatory scheme aimed at all fully qualified and trainee civil servants in the three public service functions as well as members of the judiciary.

Who is the RAFP for?

Anyone who is a :

- civil servant, including on secondment;

- a member of the judiciary;

- a member of the military, whether permanent, under contract or a reservist...

... and who receives ancillary remuneration (bonuses, allowances, in-kind benefits, etc.) that the basic public service schemes do not take into account, contributes to the Scheme.

The following are excluded:

- local employees of territorial authorities or public hospitals in French overseas collectivities,

- civil servants with disponibilité (available) or hors cadres (expatriate) status,

- fully qualified civil servants who work fewer than 28 hours a week.

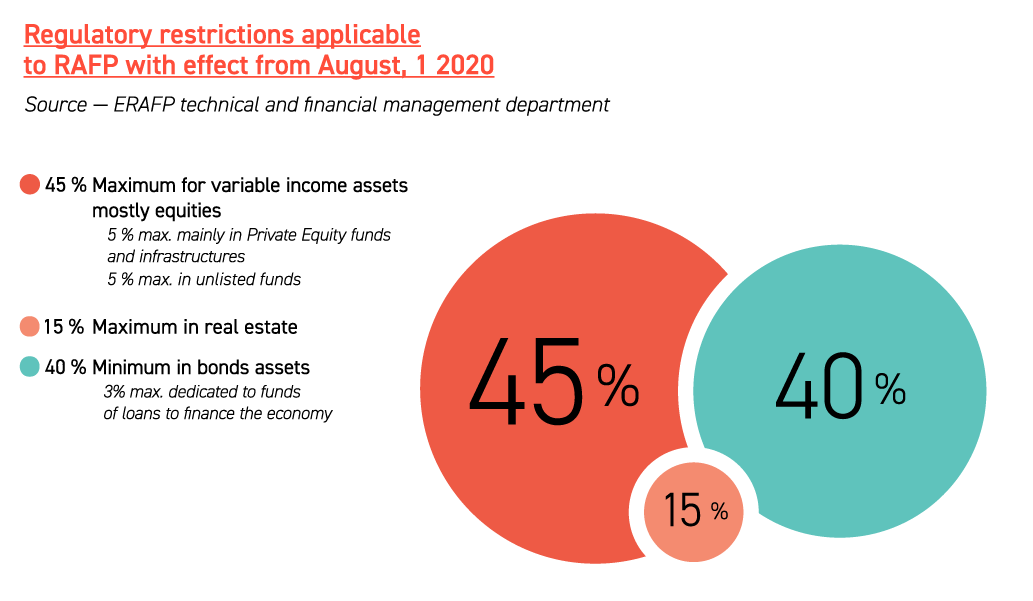

SRI values and financial management

The Scheme’s management has been entrusted by decree to Établissement de retraite additionnelle de la fonction publique (ERAFP), a State-supervised public administrative institution.

ERAFP’s core business is to manage the Scheme technically and financially so as to maximise the return on the assets it invests, which will form the basis of contributors’ future pension income once they reach their additional pension liquidation age.

Governed by strict prudential rules pursuant to article 28 of the decree of 18 June 2004, this management makes it possible to maintain a coverage ratio of at least 100%.

By its nature, ERAFP is therefore dedicated to the public interest and, in particular, highly attuned to social issues. Accordingly, as soon as it was created in 2005, it put in place an innovative and ambitious programme to implement a socially responsible investment (SRI) policy founded on public service values. This policy takes into account environmental, social and governance criteria in each of the Scheme’s investments.

As the only French public pension fund, ERAFP seeks to demonstrate that investors can serve the public interest without forgoing the financial return on their investments. It has thus targeted three specific areas for investment: the fight against climate change, support for economic activity and financing affordable housing for public sector employees.

It excludes from its investment universe all areas prohibited under French law or French-ratified international conventions.

These exclusions aside, as a large institutional investor ERAFP invests in all business sectors and asset classes.